10 Undeniable How To Calculate My Social Security Benefit Full

13 Trustworthy How To Calculate My Social Security Benefit - Make sure you only include the portion of your. Social security estimates that the average monthly retirement and ssdi benefits in january 2022 will be $1,657 and $1,358, respectively.

See Your Social Security Benefits Estimate In an . Social security also provides survivor benefits to a divorced spouse if the marriage lasted 10 years, or if the divorced spouse cares for a natural.

See Your Social Security Benefits Estimate In an . Social security also provides survivor benefits to a divorced spouse if the marriage lasted 10 years, or if the divorced spouse cares for a natural.

How to calculate my social security benefit

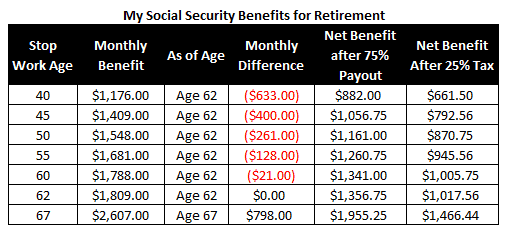

7 Compulsive How To Calculate My Social Security Benefit. The social security benefits calculation uses your highest 35 years of earnings to calculate your average monthly earnings. The benefit amount for case b, assuming that benefits begin exactly at normal retirement age of 66 years and 4 months, is not reduced except for rounding down to the next lower dollar. You may be entitled to a spousal benefit because of your partner's work history. How to calculate my social security benefit

However, the extent of social security benefits can often be uncl Your social security benefit also depends on how old you are when you take it. How to calculate social security survivor’s benefits.” social security calculation step 3: How to calculate my social security benefit

There’s a calculator on the social security website that allows you to enter your information to find out how your spousal benefit will be affected if you file prior to your full retirement age. Note that the age at which the other spouse files for social security benefits doesn’t affect this calculation. The $2,079.60 pia is thus reduced to a monthly benefit of $1,455.00. How to calculate my social security benefit

How those credits are calculated is complex, but you will likely qualify if you have worked for at least 10 years. Your primary insurance amount (pia). How to calculate a widow's benefits for social security. How to calculate my social security benefit

A social security spousal benefit is calculated as 50% of the other spouse’s pia. Social security provides the security of survivors benefits to the spouse and children of a deceased worker. Whether they have retired or can no longer work due to a disability, social security is a safety net that provides them with necessary income. How to calculate my social security benefit

Primary insurance amount (pia) calculation now you’re ready to determine the heart of your benefit; See my article “if you die early: And regardless of whether you think social security’s future is secure, the fact remains that you shouldn’t plan. How to calculate my social security benefit

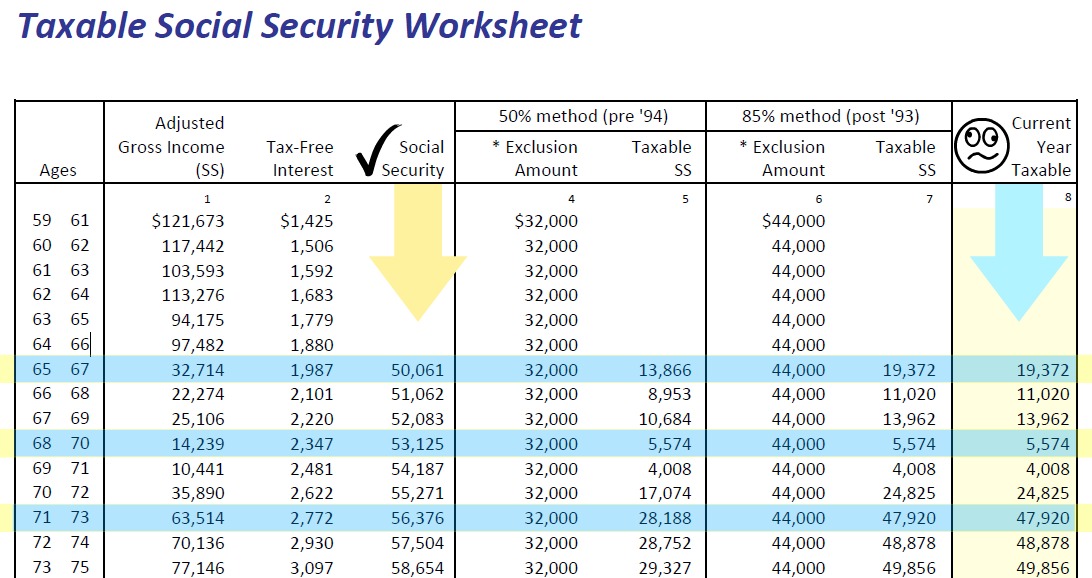

Social security is an important part of our retirement. 44 rows benefit calculation examples for workers retiring in 2022. (irs form 1040 lines 1, 2a, 2b, 3b, 4b, 4d, 5b, and 6a and schedule 1 (form 1040) line 9) enter the total of any exclusion for u.s. How to calculate my social security benefit

The new version of the benefits calculator requires less input from the user by making use of. If you start collecting your benefits at age 65 you could receive approximately $33,773 per year or $2,814 per. The social security administration rolled out a new version of its online benefits calculator today. How to calculate my social security benefit

Most baby boomers rely on social security to provide them with income after they have reached a certain age. First, social security adjusts your earnings for historical changes in u.s. Jane files for her retirement benefit at age 63 and is therefore receiving a retirement benefit that is smaller than her pia. How to calculate my social security benefit

The $3,313.80 pia is thus reduced to a monthly benefit of $3,313.00. +how to calculate my social security benefit? Social security may provide $33,773. How to calculate my social security benefit

You can start collecting at age 62, the minimum retirement age , but you’ll get a bigger monthly payment if you wait until full retirement age , which is 66 but is gradually moving to 67 for people born in 1960 or after. Taxpayer expense you can find a detailed explanation about You can calculate this by looking at your annual income each year. How to calculate my social security benefit

For security, the quick calculator does not access your earnings record; The average social security benefit amount is about $18,000 per year, so most people will not owe taxes on their social security payout. For married couples, the income limit increases to $32,000. How to calculate my social security benefit

If you have an online my social security account , you can check your projected retirement and disability benefit amounts. Benefit calculators frequently asked questions benefit estimates depend on your date of birth and on your earnings history. Then, multiply this number by 6.2% (0.062) to calculate your social security tax. How to calculate my social security benefit

Your social security benefit is based on your average indexed monthly earnings (aime). Social security administration publication no. Instead, it will estimate your earnings based on information you provide. How to calculate my social security benefit

If you do not have 35 years of earnings, a zero will be used in the calculation, which will lower the average. To be eligible for social security benefits, you must earn at least 40 credits over your working career. How it’s figured produced and published at u.s. How to calculate my social security benefit

Enter total annual social security (ss) benefit amount. How to calculate my social security benefit

social security benefits calculator 2016 Spreadsheets . Enter total annual social security (ss) benefit amount.

How does Social Security calculate my benefits . How it’s figured produced and published at u.s.

How does Social Security calculate my benefits . How it’s figured produced and published at u.s.

Social Security Tax Equation Tessshebaylo . To be eligible for social security benefits, you must earn at least 40 credits over your working career.

Social Security Tax Equation Tessshebaylo . To be eligible for social security benefits, you must earn at least 40 credits over your working career.

How the Social Security Benefits Calculation Works . If you do not have 35 years of earnings, a zero will be used in the calculation, which will lower the average.

How the Social Security Benefits Calculation Works . If you do not have 35 years of earnings, a zero will be used in the calculation, which will lower the average.

Calculating Taxable Social Security Benefits Not as Easy . Instead, it will estimate your earnings based on information you provide.

Calculating Taxable Social Security Benefits Not as Easy . Instead, it will estimate your earnings based on information you provide.

How to Calculate Social Security Benefits 13 Steps . Social security administration publication no.

How to Calculate Social Security Benefits 13 Steps . Social security administration publication no.

Social Security Benefits The Kid Picked Last for Dodgeball . Your social security benefit is based on your average indexed monthly earnings (aime).

Social Security Benefits The Kid Picked Last for Dodgeball . Your social security benefit is based on your average indexed monthly earnings (aime).

Calculator figures how much social security benefit is taxable . Then, multiply this number by 6.2% (0.062) to calculate your social security tax.

Calculator figures how much social security benefit is taxable . Then, multiply this number by 6.2% (0.062) to calculate your social security tax.