7 Inspiring How To Learn How To Do Payroll Latest

5 Uncovered How To Learn How To Do Payroll - And then you set about making deductions in the right order. Once you have completed all of the necessary information for each employee, you will see a list of employees on your payroll for the year.

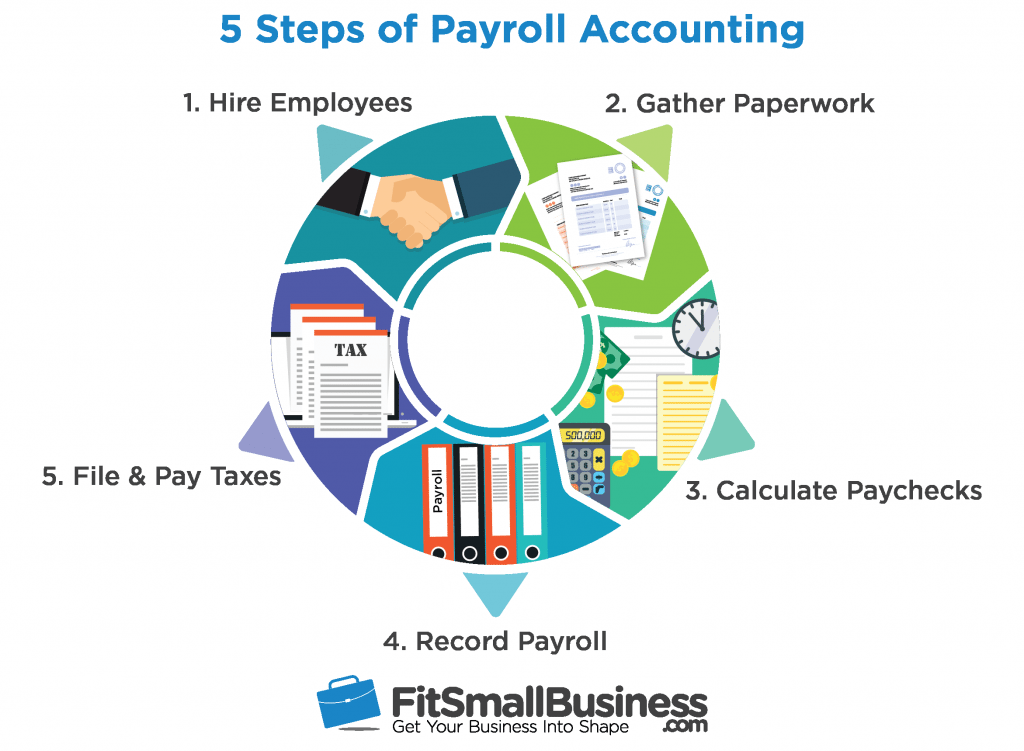

How to Do Payroll Accounting A StepbyStep Guide . With a team of extremely dedicated and quality lecturers, learn how to do payroll will not only be a place to share knowledge but also to help students get inspired to explore and discover many creative ideas from themselves.clear and.

How to Do Payroll Accounting A StepbyStep Guide . With a team of extremely dedicated and quality lecturers, learn how to do payroll will not only be a place to share knowledge but also to help students get inspired to explore and discover many creative ideas from themselves.clear and.

How to learn how to do payroll

5 Inspiring How To Learn How To Do Payroll. Manually do calculations if you’re willing to read up on tax laws and do your own calculations, you might be interested in learning how to do your own payroll. Collect your employees’ payroll forms when hired. Figure 7, how employee pay is calculated each payday. How to learn how to do payroll

Gather your tax information if this is your first time running payroll, you’ll need to set up an employer identification number (ein) with the irs. If you don’t want to learn how to do Learn how to do your small business payroll in seven steps. How to learn how to do payroll

You start by calculating pay for each employee, according to the terms of their contract. To learn more about deduction and contribution limits, check our how to do payroll guide. There are a few things you should know before setting up payroll. How to learn how to do payroll

Charlette beasley published april 23, 2021 charlette has over 10 years of experience in accounting and finance and 2 years of partnering. Figure out the employee’s gross pay. Learn how to do payroll provides a comprehensive and comprehensive pathway for students to see progress after the end of each module. How to learn how to do payroll

The first step is the easiest, as all that you need to do is multiply the employee's hours worked by his or her hourly rate of pay. Managing payroll is definitely a huge task and should be taken seriously by any firm or company. It’s up to you to channel the money to all the right recipients by the agreed dates. How to learn how to do payroll

Actually is payroll difficult to learn? Human resources | how to how to do payroll with paychex written by: How do you manually process payroll? How to learn how to do payroll

If your planning on increasing in your bookkeeping knowledge learn payroll by all means. Learning how to do your own payroll can be very daunting. Calculate how much gross pay you owe each employee. How to learn how to do payroll

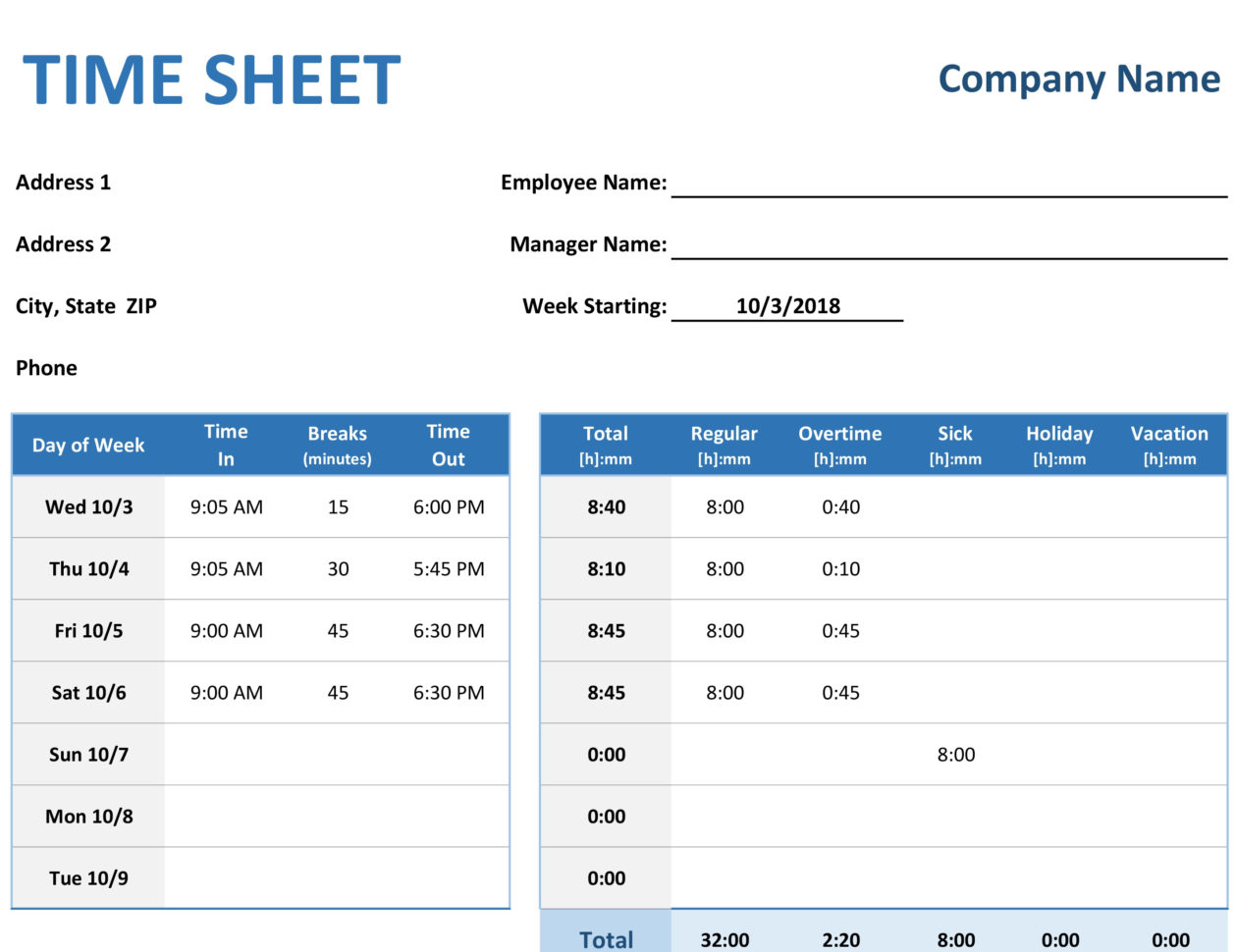

Collect time sheets, review & approve. Determine the employee's gross wage. Do you have a business in canada? How to learn how to do payroll

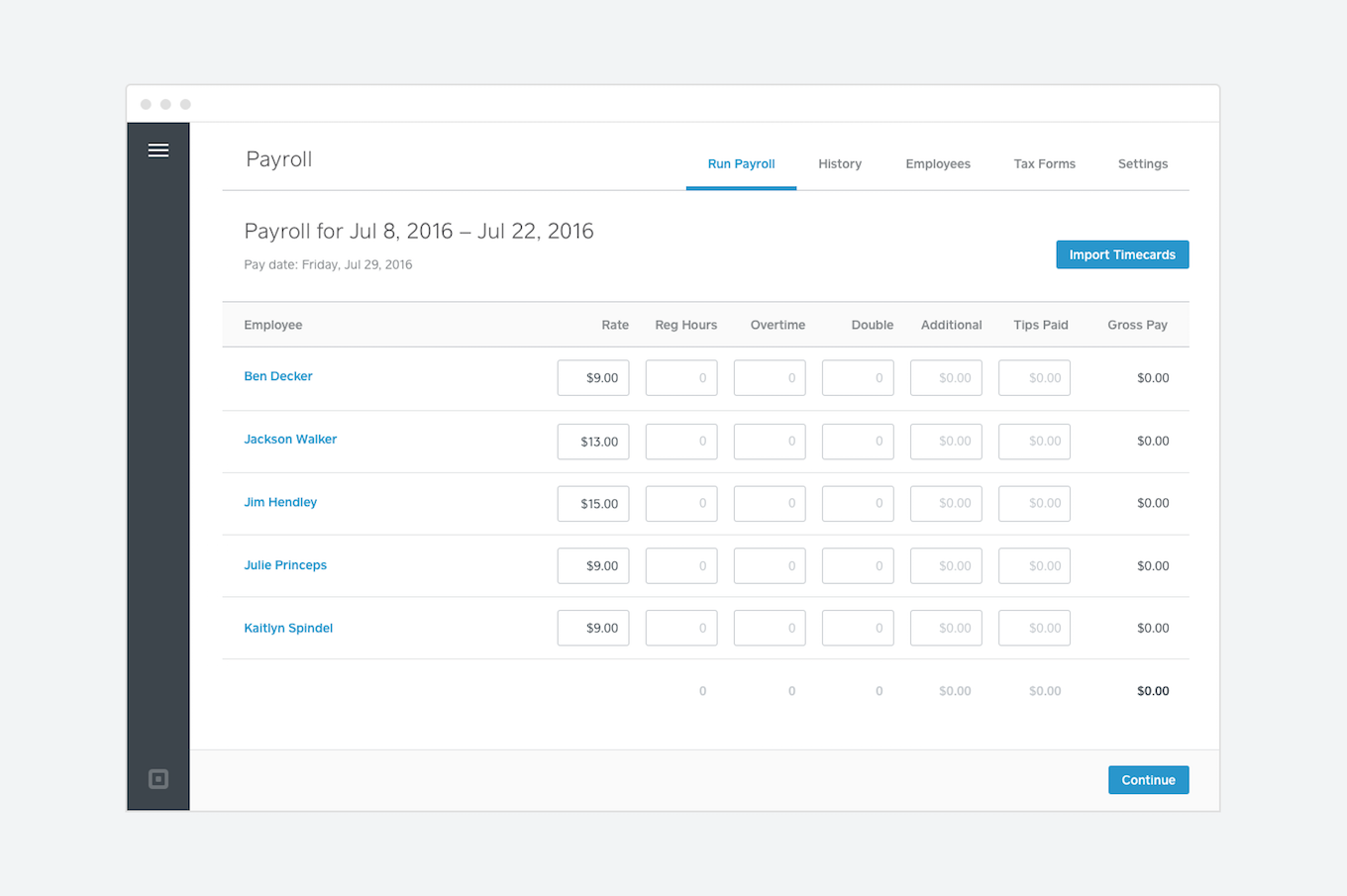

Gusto’s payroll run process can be completed in six simple steps, starting with heading to your gusto dashboard and selecting run payroll. Once you have the process down, running payroll with gusto can be done in less than a minute. Doing payroll by hand is the least expensive payroll option. How to learn how to do payroll

How to do payroll in 8 steps (+ free checklist) set your business up as an employer. With square payroll, you can find copies of your tax filings in your dashboard. Let’s cover a few simple steps for payroll processing. How to learn how to do payroll

Running payroll with gusto is quick, easy, and straightforward. Hiring an accountant is the most expensive option, but it’s reliable. If you’re a small business with only a few employees and choose to process payroll manually, you will need to keep precise records of hours worked, wages paid and worker classifications, among other details. How to learn how to do payroll

You have the foundation laid, and now your small business is ready to start actually paying employees. You'll need to do some calculations for each employee to determine what to pay them and what to withhold for payroll tax purposes. Whether you can do it correctly, however, will How to learn how to do payroll

5 simple steps to follow. Especially for a small businesses. How do you calculate payroll deductions? How to learn how to do payroll

If you plan to save on costs and put your brain to work, use the following steps to learn how to do payroll manually. Find here tips on how to do payroll for small business before proceeding on the methodology of the construction of a. How to learn how to do payroll

Steps on How to Do Payroll Yourself . Find here tips on how to do payroll for small business before proceeding on the methodology of the construction of a.

Steps on How to Do Payroll Yourself . Find here tips on how to do payroll for small business before proceeding on the methodology of the construction of a.

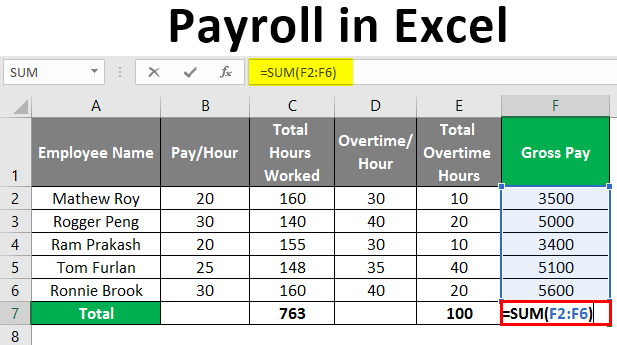

The Microsoft Excel Step By Step Training Guide Book . If you plan to save on costs and put your brain to work, use the following steps to learn how to do payroll manually.

The Microsoft Excel Step By Step Training Guide Book . If you plan to save on costs and put your brain to work, use the following steps to learn how to do payroll manually.

How to do Payroll Taxes and Process Payroll Yourself . How do you calculate payroll deductions?

How to do Payroll Taxes and Process Payroll Yourself . How do you calculate payroll deductions?

How To Do Payroll Yourself With An LLC . Especially for a small businesses.

How To Do Payroll Yourself With An LLC . Especially for a small businesses.

5 Things You Need to Know Before You Learn how to Do . 5 simple steps to follow.

How to Do a Payroll Reconciliation for Small Businesses . Whether you can do it correctly, however, will

How to Do a Payroll Reconciliation for Small Businesses . Whether you can do it correctly, however, will

How To Create Payroll In Excel How To Create Salary . You'll need to do some calculations for each employee to determine what to pay them and what to withhold for payroll tax purposes.

How To Create Payroll In Excel How To Create Salary . You'll need to do some calculations for each employee to determine what to pay them and what to withhold for payroll tax purposes.

How to Do Payroll Accounting A StepbyStep Guide . You have the foundation laid, and now your small business is ready to start actually paying employees.

How to Do Payroll Accounting A StepbyStep Guide . You have the foundation laid, and now your small business is ready to start actually paying employees.

How Do I Prepare for a Payroll Audit? (with picture) . If you’re a small business with only a few employees and choose to process payroll manually, you will need to keep precise records of hours worked, wages paid and worker classifications, among other details.