10 Approved How To Calculate Internal Rate Of Return On Excel Latest

5 Sly How To Calculate Internal Rate Of Return On Excel - The page explains what is internal rate of return and how to calculate irr using excel formulas. In financial modeling, the xirr function is useful in the xirr function is.

Internal Rate Of Return Cash Flow Rating Walls . By using the internal rate of return (irr), you can plan for future growth and expansion of that investment.

Internal Rate Of Return Cash Flow Rating Walls . By using the internal rate of return (irr), you can plan for future growth and expansion of that investment.

How to calculate internal rate of return on excel

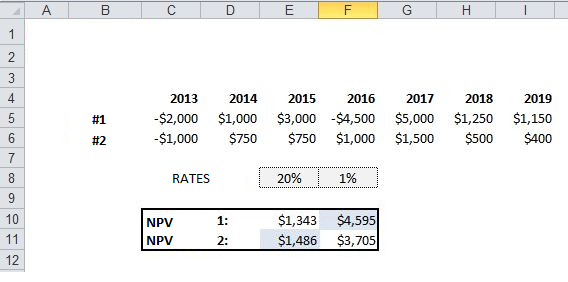

9 Helpful How To Calculate Internal Rate Of Return On Excel. You might use the following excel function: Instead of discounting the cash flows at the determined required rate of return to arrive at the net present value, the irr method determines the discount rate that causes the npv to be equal to zero. In any cells of a blank column, type =mirr (. How to calculate internal rate of return on excel

=irr(payments_range) there is no exact and universal formula. It will give any business useful numbers to decide on investments with a simple formula. Irr is the discount rate that results in the investment’s net present value of zero. How to calculate internal rate of return on excel

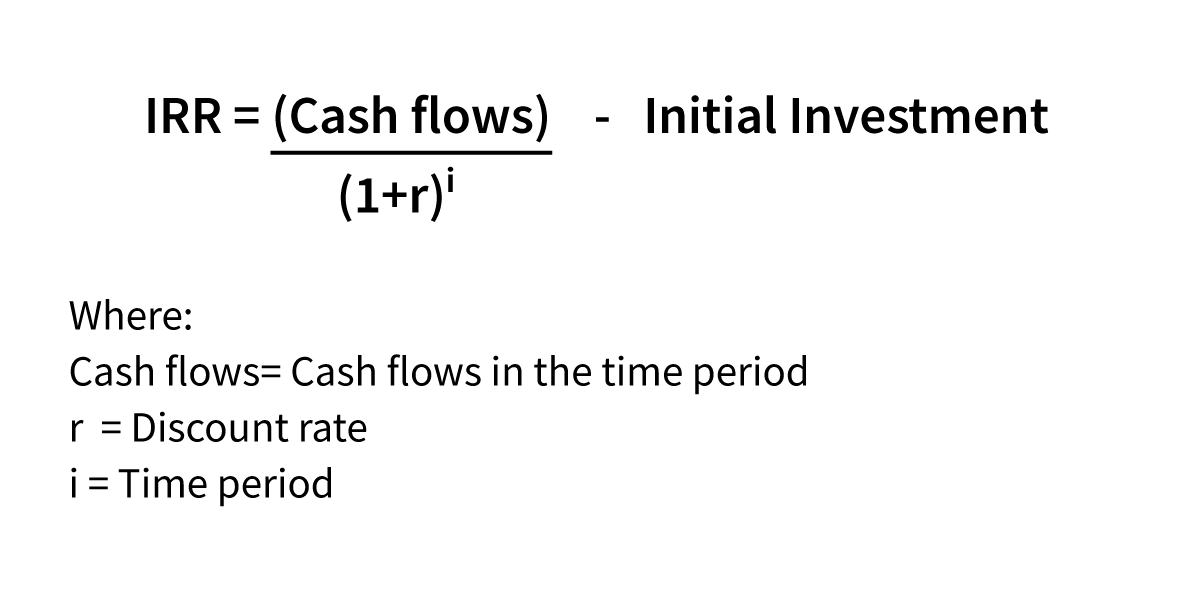

Calculate internal rate of return of an investment for the initial investment of $10,000, the earnings of the 1 st , 2 nd , 3 rd , and 4 th quarters are given in the above table. The npv is calculated by taking the total summation of the cash flow and then multiplying that by the dividend of net cash outflows divided by one plus the discount rate of return. The article talks about how the irr is used in evaluating projects and investments. How to calculate internal rate of return on excel

To easily calculate those numbers, use the irr formula in microsoft excel. The download below allows you to work. Internal rate of formula is also given as: How to calculate internal rate of return on excel

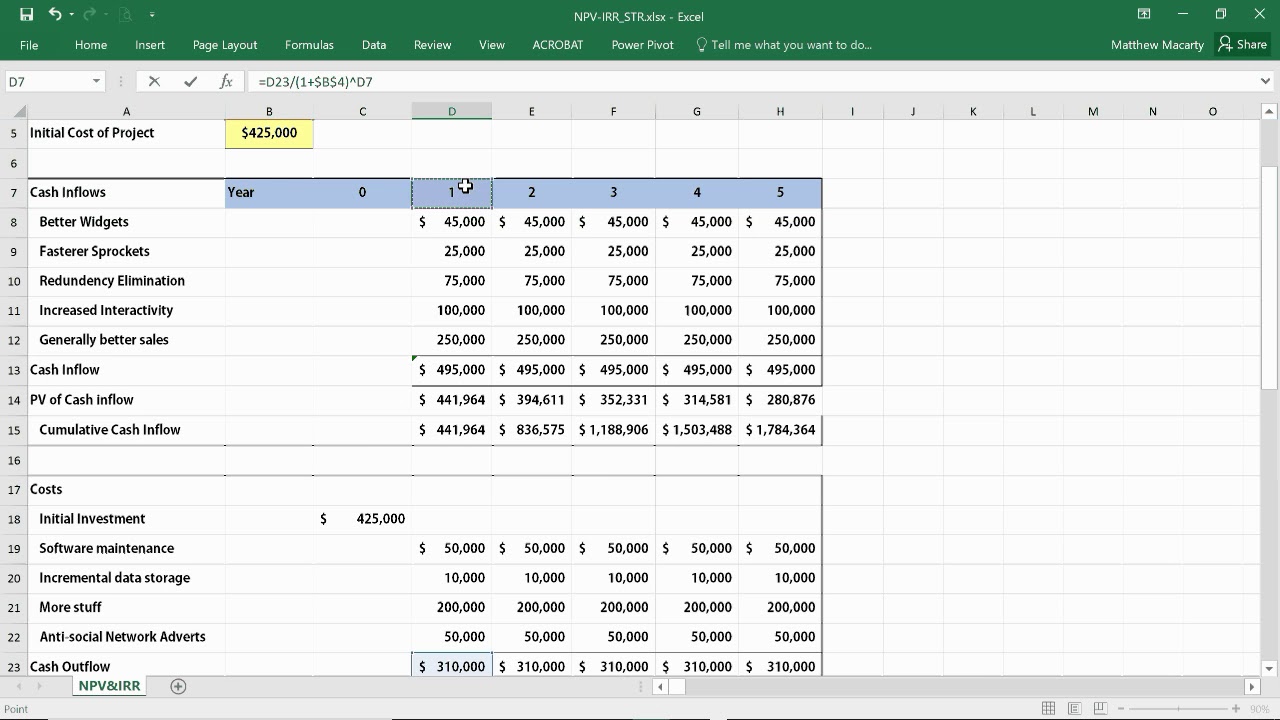

Calculate internal rate of return using excel. Entering values (cash flow) select the finance_rate, it’s required return which is 10%. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. How to calculate internal rate of return on excel

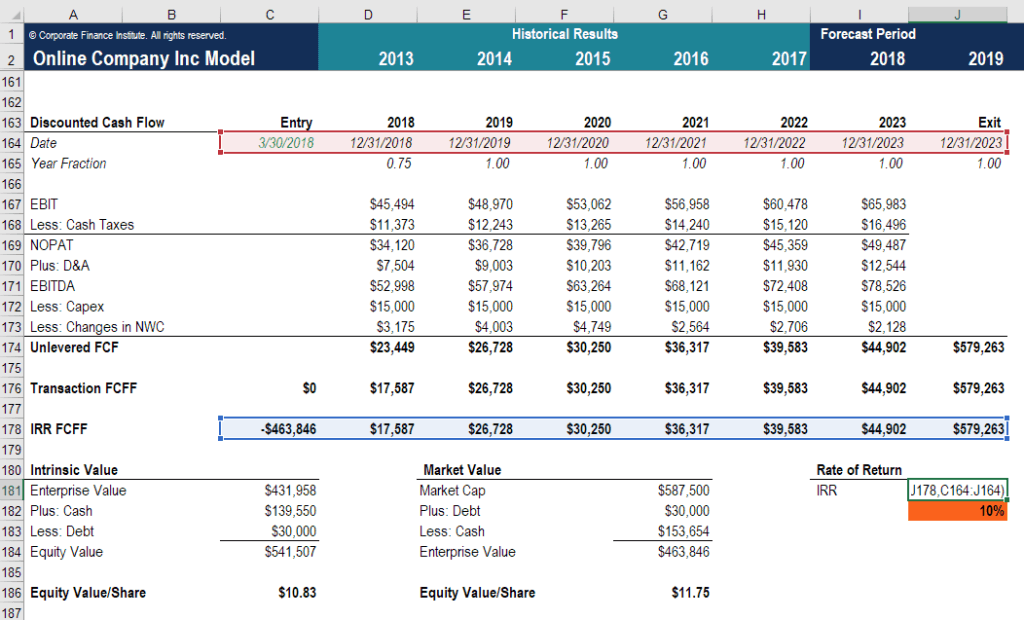

How to calculate irr (internal rate of return) in excel irr is the acronym for internal rate of return.it is defined in the terms of npv or net present value. Using the example data shown above, the irr formula would be =irr(d2:d14,.1)*12, which yields an internal rate of. The function will calculate the internal rate of return (irr) for a series of cash flows that may not be periodic. How to calculate internal rate of return on excel

Using excel formula to calculate irr is very straight forward, we just using the excel formula (irr) and select the cash flow from all periods. The syntax of the mirr function is as follows: In the image below, we calculate the irr of the investment as in the previous example. How to calculate internal rate of return on excel

Cf1, cf2, cf3, cf4.cfnk are cash inflows. So if you know how to calculate the irr, then you’re pretty much 60% on your way to knowing how to value bonds. We put in values in the mirr (values, finance_rate, reinvest_rate) function in excel. How to calculate internal rate of return on excel

Irr is a discount rate, whereby npv equals to zero. Xirr function the xirr function is categorized under excel financial functions. Generally, the easiest way to calculate irr is using an excel spreadsheet. How to calculate internal rate of return on excel

It is a complex calculation usually done using computer software or advanced calculators. Here, the initial investment is entered with a negative sign as its showing payment outgoing, and the quarterly earnings are represented by positive values. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features How to calculate internal rate of return on excel

Internal rate of return is another method used for cash flow valuation. The irr is used to make the net present value (npv) of cash flows from a project/investment equal to zero. In other words, the irr is a “break even” rate of return on the investment. How to calculate internal rate of return on excel

The excel irr function returns the internal rate of return for a series of periodic cash flows represented by positive and negative numbers. The result can be slightly different from the manual. In fact, a bond’s discount rate (aka yield to maturity, or more simply, yield) is its internal rate of return! How to calculate internal rate of return on excel

In this tutorial you will learn how to calculate the internal rate of return, or irr, in microsoft excel. In all calculations, it's implicitly assumed that: The irr can be stated as the discount rate that makes the npv of all cash flows ( both positive and negative cash flows) from a project or investment equal to zero. How to calculate internal rate of return on excel

0 = n p v = ∑ n = 0 n c f n 1 + i r r) n − c f 0. Select the values, which is cash flow. Mirr (values, finance_rate, reinvest_rate) where: How to calculate internal rate of return on excel

N = total number of periods. There are equal time intervals between all cash flows. If the cash flows are periodic, we should use irr function. How to calculate internal rate of return on excel

To calculate irr, companies or investors will find the discount rate that makes the present value of all future cash flows and the investment’s future value equal to the original investment. How to calculate irr in excel though it isn’t a straightforward calculation Find out how to calculate the internal rate of return on different investment scenarios using microsoft excel. How to calculate internal rate of return on excel

Then, excel will do the work for us. The mirr function in excel calculates the modified internal rate of return for a series of cash flows that occur at regular intervals. The article also talks about when it is safe to use irr How to calculate internal rate of return on excel

All cash flows occur at the end of a period. Click here to download irr calculation in an excel file. How to calculate internal rate of return on excel

How to Calculate NPV, IRR & ROI in Excel Net Present . Click here to download irr calculation in an excel file.

How to Calculate NPV, IRR & ROI in Excel Net Present . Click here to download irr calculation in an excel file.

How to calculate IRR (internal rate of return) in Excel (9 . All cash flows occur at the end of a period.

How to calculate IRR (internal rate of return) in Excel (9 . All cash flows occur at the end of a period.

Download Irr And Npv Examples Gantt Chart Excel Template . The article also talks about when it is safe to use irr

Download Irr And Npv Examples Gantt Chart Excel Template . The article also talks about when it is safe to use irr

Internal Rate Of Return Calculator For Annuity Rating Walls . The mirr function in excel calculates the modified internal rate of return for a series of cash flows that occur at regular intervals.

Internal Rate Of Return Calculator For Annuity Rating Walls . The mirr function in excel calculates the modified internal rate of return for a series of cash flows that occur at regular intervals.

Calculating IRR with Excel Investopedia . Then, excel will do the work for us.

Calculating IRR with Excel Investopedia . Then, excel will do the work for us.

How to Calculate IRR Formula Excel Example Zilculator . Find out how to calculate the internal rate of return on different investment scenarios using microsoft excel.

How to Calculate Internal Rate of Return (IRR) in Excel . How to calculate irr in excel though it isn’t a straightforward calculation

Example of IRR (Internal Rate of Return) calculation in . To calculate irr, companies or investors will find the discount rate that makes the present value of all future cash flows and the investment’s future value equal to the original investment.

Example of IRR (Internal Rate of Return) calculation in . To calculate irr, companies or investors will find the discount rate that makes the present value of all future cash flows and the investment’s future value equal to the original investment.

How to calculate IRR (internal rate of return) in Excel (9 . If the cash flows are periodic, we should use irr function.

How to calculate IRR (internal rate of return) in Excel (9 . If the cash flows are periodic, we should use irr function.