10 Undeniable How To Pay Tax Back Full

7 Basic How To Pay Tax Back - 6 years for filing back taxes, 3 years to claim a refund. Click on the button below and enter some basic information and we will do the rest.

How to Read Your Pay Stub . Knowing how to pay taxes for a small business is complicated and, with the continually changing world of sales tax regulations, can quickly lead to a headache.

How to Read Your Pay Stub . Knowing how to pay taxes for a small business is complicated and, with the continually changing world of sales tax regulations, can quickly lead to a headache.

How to pay tax back

13 Studies How To Pay Tax Back. The easiest way to pay is with bpay or a credit or debit card. Sales tax as refund, if you are exporting If you pay more tax than you owe, you are eligible for a tax refund. How to pay tax back

Make your cheque payable to ‘hm revenue and customs only’. How to file back taxes. You can only claim a refund for the last four years, so it’s important to make sure you apply for your tax refund before this time runs out. How to pay tax back

Multiply this figure by the number of pay periods they’re owed back pay for. Make sure you're paying the right amount so you do not end up with a large bill. Doing the dishes, making doctor’s appointments, taking out the trash. How to pay tax back

Tax relief and income assistance is available to people affected by the downturn in business due. Or local govt and does not go to the federal government. The most important fact you need to know is that back pay for employees is not mandated by the law, which means there is no law stating that every company needs to provide back pay for. How to pay tax back

Write your tax credit reference number on. Paying back a working or child tax credits overpayment. Since the advance tax credit is based on 2019 and 2020 tax returns, some people may get overpaid or receive money that’s not meant for them. How to pay tax back

The employer who wrongfully terminated the employee would owe them $15,392 in back pay for those16 pay periods of missed wages. So, you usually get the state sales tax or local govt. Most of us pay advance tax on our income, ensuring that the overall tax liability is split up into portions, thereby reducing burden on us to pay a lump sum in one go. How to pay tax back

Letter 6419 will help you understand if you received too much money from the irs. This advice applies to england. A look at our salary slips shows the amount deducted every month as tax , with this computation being done at an approximate level, but the actual tax liability can differ from the amount which has been. How to pay tax back

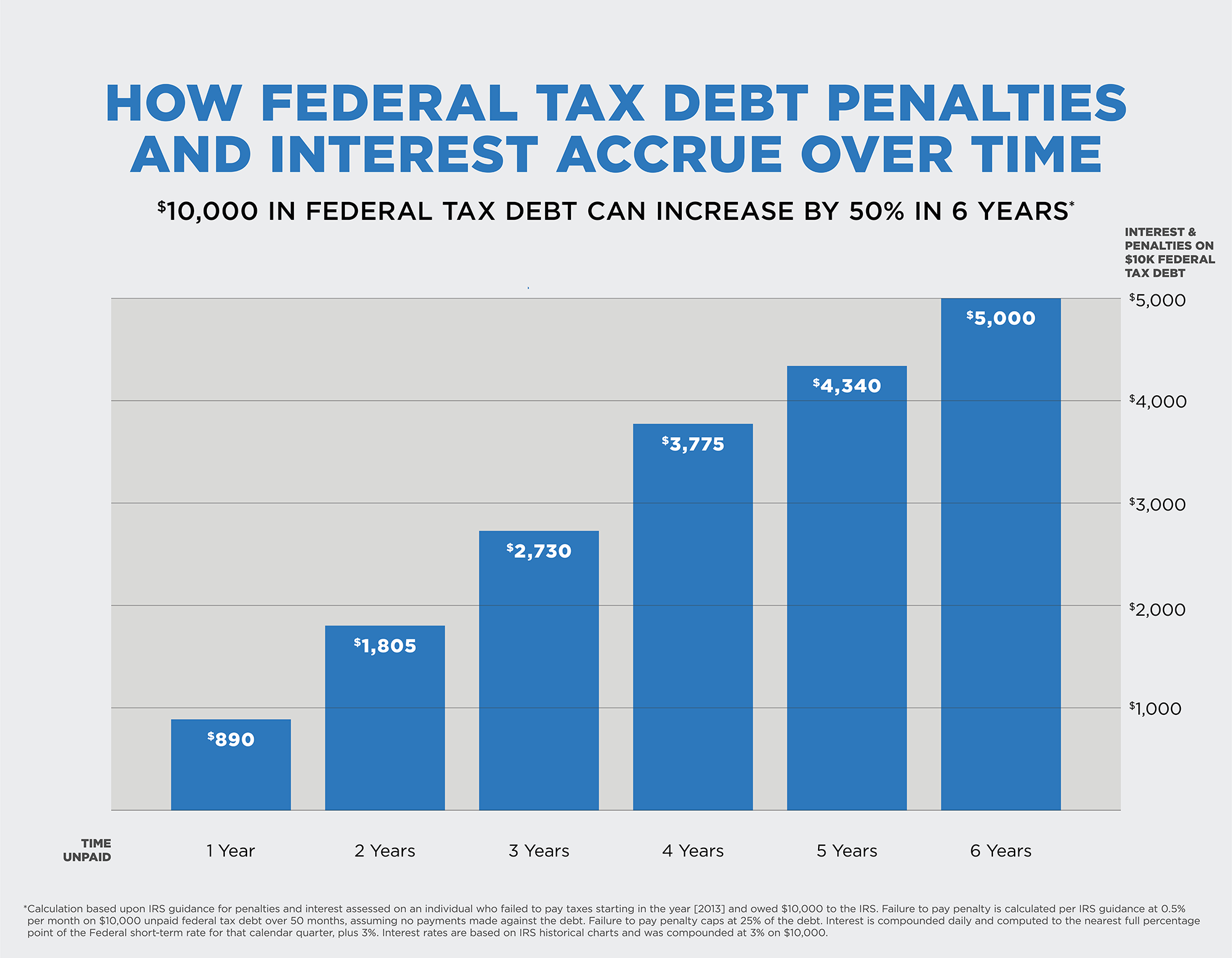

Back pay, or “final pay,” means that this will be the last salary your employer will give you once you end your service with them—whether you resigned or were terminated. If you fall behind on your taxes, it doesn’t take long for the irs to start breathing down your neck. How to avoid having to pay back your child tax credit it’s important for families to confirm that their information with the irs is updated to avoid a. How to pay tax back

How to handle back taxes. There might not be a hard limit to how many years you have to file back taxes, but that’s not to say that the irs doesn’t want your returns sooner rather than later. National insurance if you earn more than £184 a week. How to pay tax back

Understanding the basic rules of sales tax, avoiding some common stumbling blocks, and finding a comprehensive tax solution to help you move forward, will bring continued success and growth, no matter your industry. How to make a payment to the ato. [$50,000 salary] / 52 pay periods = $962 per pay period. How to pay tax back

You must have filed tax returns for the last six years to be considered in “good standing” with the irs. Taxpayers can pay tax bills directly from a checking or savings account free with irs direct pay. Parents who received advance child tax credits need to be on the lookout for a letter from the irs summarizing how much money was received in 2021. How to pay tax back

If you have a tax credits overpayment you must pay back, you should deal with it as soon as possible. Pay at your branch by cash or cheque. Taxpayers receive instant confirmation once they’ve made a payment. How to pay tax back

The sales tax you pay for shopping in us goes to the respective state govt. [$962 per pay period] x [16 pay periods] = $15,392. With direct pay, taxpayers can schedule payments up to 30 days in advance. How to pay tax back

Click here to apply for your ppi allowance. This means revenue will pay back the tax that you overpaid. If you’re earning any sort of income, you have to pay tax. How to pay tax back

We also have other payment options available. They can change or cancel a payment two business days before the scheduled payment date. Here is how to know if you will need to pay back the. How to pay tax back

Phone the government easypay service on 1300 898 089. How to pay tax back

How to Pay off Student Loans Fast . Phone the government easypay service on 1300 898 089.

How to Pay off Student Loans Fast . Phone the government easypay service on 1300 898 089.

How to Pay Back Taxes You Owe to the IRS . Here is how to know if you will need to pay back the.

How to Pay Back Taxes You Owe to the IRS . Here is how to know if you will need to pay back the.

Do I have to pay back my child tax credit and how do I opt . They can change or cancel a payment two business days before the scheduled payment date.

Do I have to pay back my child tax credit and how do I opt . They can change or cancel a payment two business days before the scheduled payment date.

Why We Pay Taxes HISTORY . We also have other payment options available.

Why We Pay Taxes HISTORY . We also have other payment options available.

back pay Liberal Dictionary . If you’re earning any sort of income, you have to pay tax.

How much inheritance tax do I have to pay? Smart Will . This means revenue will pay back the tax that you overpaid.

How much inheritance tax do I have to pay? Smart Will . This means revenue will pay back the tax that you overpaid.

Taxes Here’s how to pay less, get more back, on next year . Click here to apply for your ppi allowance.

Taxes Here’s how to pay less, get more back, on next year . Click here to apply for your ppi allowance.

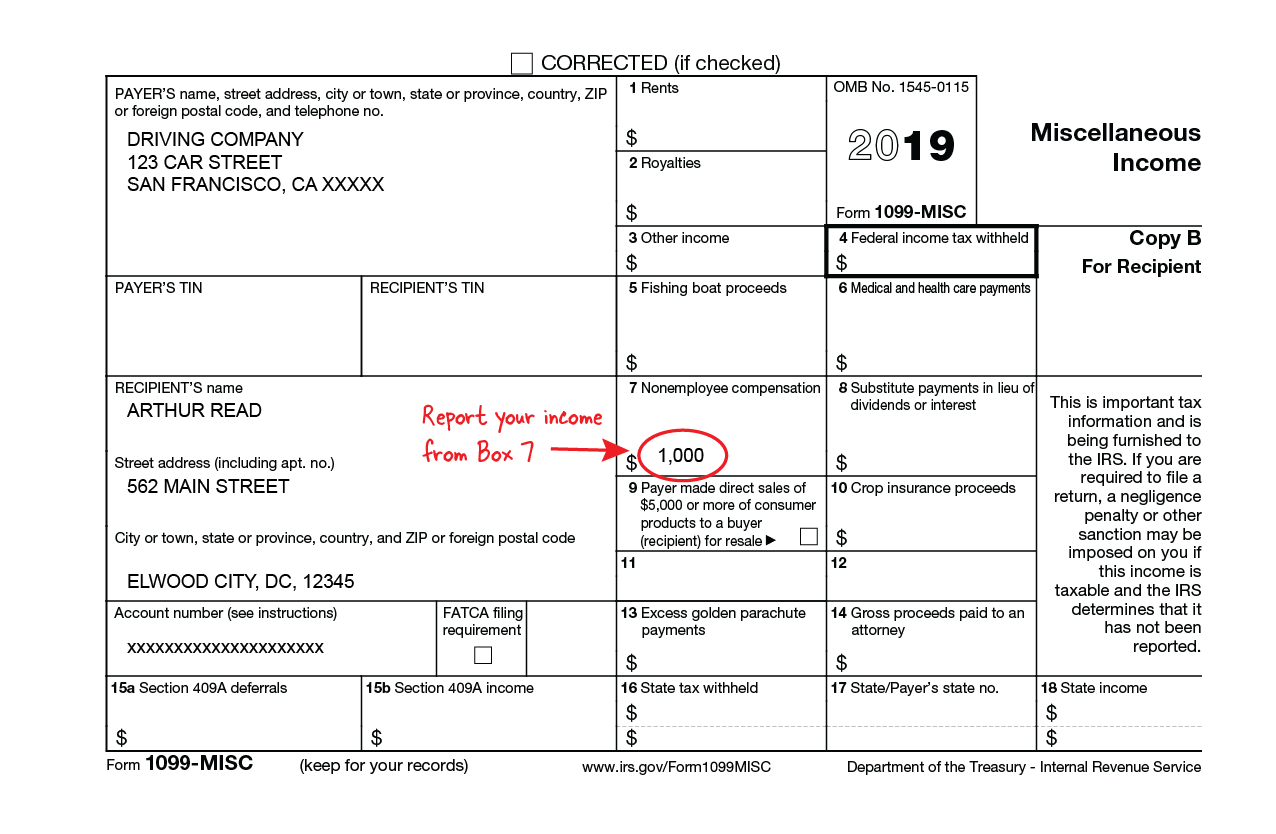

How Do Uber and Lyft Drivers Count Get It Back . With direct pay, taxpayers can schedule payments up to 30 days in advance.

How Do Uber and Lyft Drivers Count Get It Back . With direct pay, taxpayers can schedule payments up to 30 days in advance.