10 Cool How To Do Sale Tax Latest

10 Latest How To Do Sale Tax - You might be selling online, at a retail store, or at outside venues like flea markets and events. No matter what the actual tax rate is, this will make your multiplication much simpler.

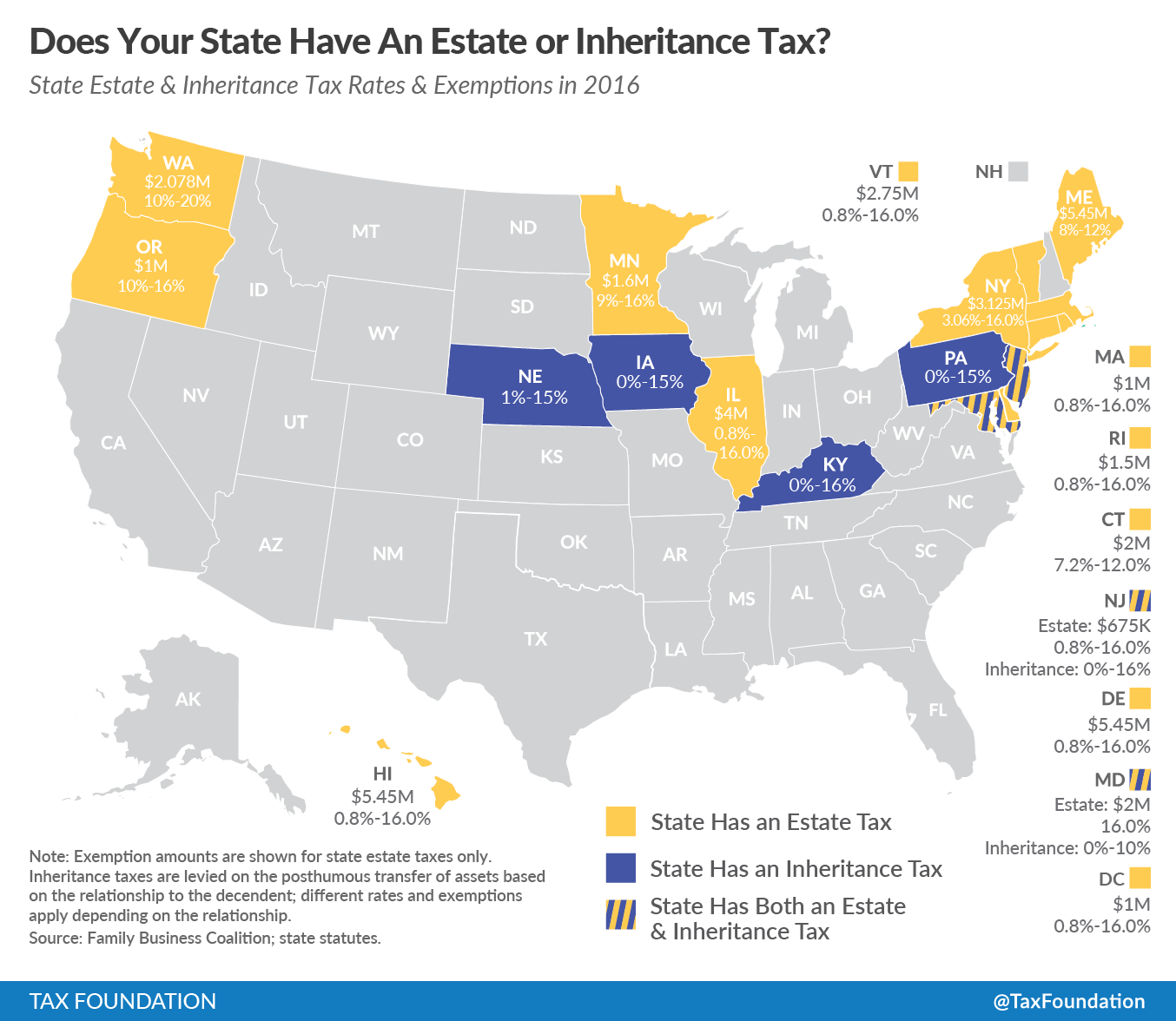

Testimony Tax Reform Proposals in Maine Tax Foundation . When do you charge sales tax?

Testimony Tax Reform Proposals in Maine Tax Foundation . When do you charge sales tax?

How to do sale tax

9 Undercover How To Do Sale Tax. How do i figure out sales tax from a total? For example, wholesalers who sell to resellers with valid reseller license should check the sales tax laws in their state as these sales are usually exempt from taxes. It’s a type of consumption tax, meaning it taxes people for spending money. How to do sale tax

The sales tax is a levy imposed on the retail sale, rental or lease of many goods and services. Wix merchants can take advantage of an automated sales tax integration with avalara , which automatically calculates sales tax for each location you sell to, so your customers always get. To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by 1 + the sales tax rate. How to do sale tax

Gather your records for all your sales and the taxes through your business accounting system. It gives homeowners a chance to pay those taxes along with high penalty fees. If you do surpass the threshold amount, then you better get moving on tax compliance in that state! How to do sale tax

In other words, if the sales tax rate is 6%, divide the sales taxable receipts by 1.06. The sales tax is imposed upon the retailer at the rate of 7% of the gross receipts from taxable sales. For example, certain states do not levy the sales tax for necessary for survival items such as groceries and prescription drugs. How to do sale tax

A sales tax is one that applies to the purchase of goods and services. Each state or locality offers various exemptions, depending on many factors including point of sale, type of product, and more. 54 rows a sales tax is a consumption tax paid to a government on the sale of certain goods. How to do sale tax

A tax lien sale is a method many states use to force an owner to pay unpaid taxes. Max tax rate with local/city sale tax california 7.25% 10.5% colorado 2.9% 10% connecticut 6.35% 6.35% delaware 0% 0% how much tax do i pay per $100? To understand which 2018 tax here are a few examples: How to do sale tax

The goal in estimating sales tax is to make the math simple. To calculate the sales tax that is included in a company’s receipts, divide the total amount received (for the items that are subject to sales tax) by “1 + the sales tax rate”. When you don't have nexus in a state, then you may have to pay attention to their notice and report laws. How to do sale tax

Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. Businesses also need to check for tax exemptions. You do not need to pay sales tax for last month ($201,000) because you had not previously met the requirement to begin collecting sales tax, and therefore you weren’t collecting any. How to do sale tax

Send reports to your state and, of course, pay sales taxes you have collected to your state. Any sale is a retail sale if the property or service sold will be used and not resold in the regular course of business. How do tax sale properties work? How to do sale tax

Round the sales tax rate to 10%. Collect sales taxes from your customers. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. How to do sale tax

How to Calculate California Sales Tax 11 Steps (with . Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

4 Ways to Calculate Sales Tax wikiHow . Collect sales taxes from your customers.

4 Ways to Calculate Sales Tax wikiHow . Collect sales taxes from your customers.

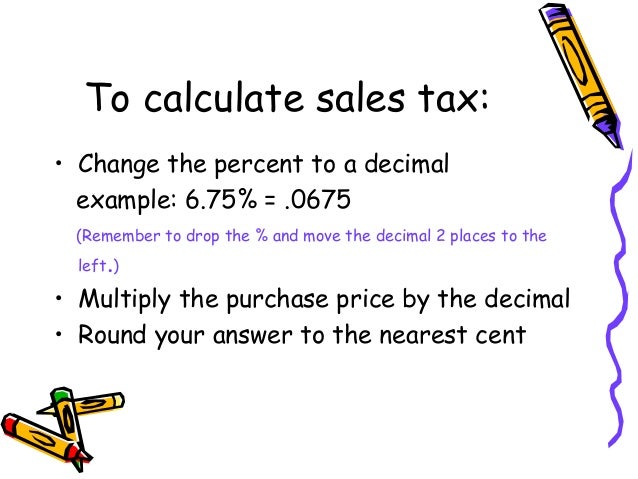

Calculating sales tax . Round the sales tax rate to 10%.

Calculating sales tax . Round the sales tax rate to 10%.

Ex Find the Sale Tax Percentage YouTube . How do tax sale properties work?

Ex Find the Sale Tax Percentage YouTube . How do tax sale properties work?

4 Ways to Calculate Sales Tax wikiHow . Any sale is a retail sale if the property or service sold will be used and not resold in the regular course of business.

4 Ways to Calculate Sales Tax wikiHow . Any sale is a retail sale if the property or service sold will be used and not resold in the regular course of business.

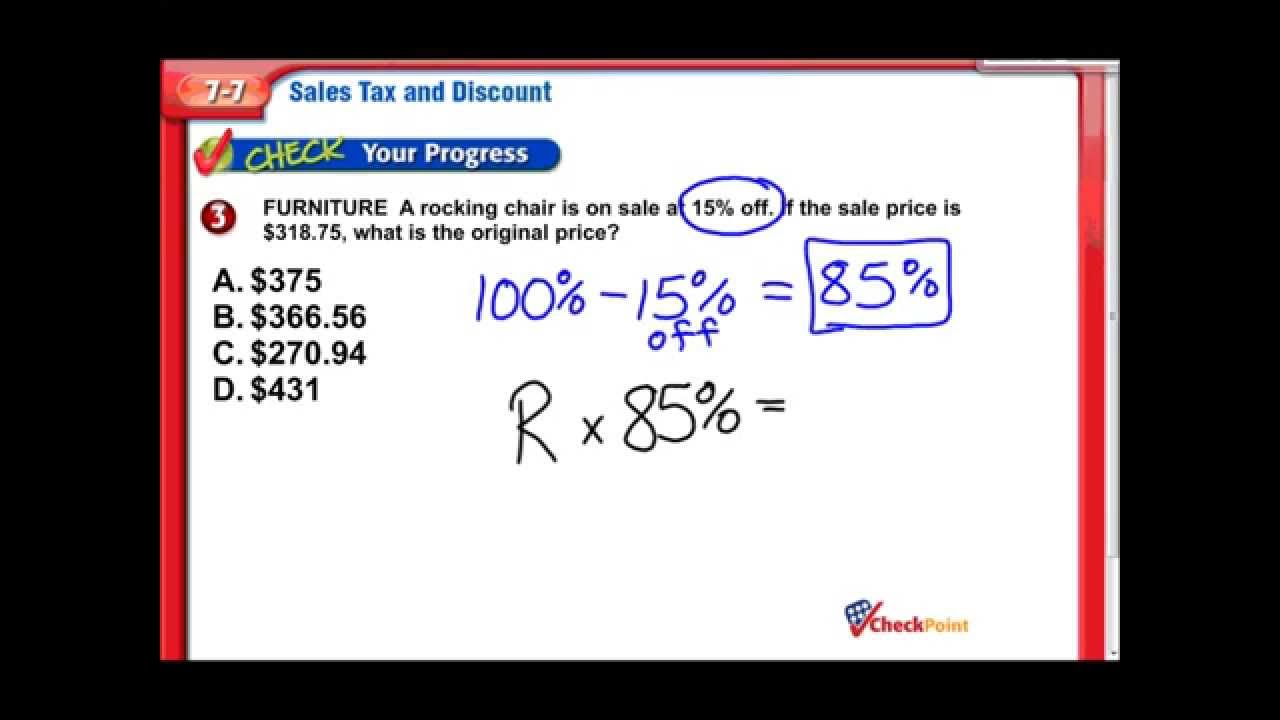

Sales Tax & Discount Middle School Math YouTube . Send reports to your state and, of course, pay sales taxes you have collected to your state.

Sales Tax & Discount Middle School Math YouTube . Send reports to your state and, of course, pay sales taxes you have collected to your state.

What is Excise Tax and How Does it Differ from Sales Tax . You do not need to pay sales tax for last month ($201,000) because you had not previously met the requirement to begin collecting sales tax, and therefore you weren’t collecting any.

What is Excise Tax and How Does it Differ from Sales Tax . You do not need to pay sales tax for last month ($201,000) because you had not previously met the requirement to begin collecting sales tax, and therefore you weren’t collecting any.

Map State and Local General Sales Tax Collections Per . Businesses also need to check for tax exemptions.

Math7 26 Sales Tax, Tips, and Markup, IP 19, page 155 . Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent.

Math7 26 Sales Tax, Tips, and Markup, IP 19, page 155 . Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent.