8 Jackpot How To Take A Loan From Your 401k Work

10 Useful How To Take A Loan From Your 401k - Whatever the reason, a loan from your 401k might be just the ticket. To get started, tell your employer that you want to borrow from your 401 (k).

How Does a 401(K) Loan Work? Self Directed Retirement Plans . 1, 2016, loans will be available through the walmart 401(k) plan.

How Does a 401(K) Loan Work? Self Directed Retirement Plans . 1, 2016, loans will be available through the walmart 401(k) plan.

How to take a loan from your 401k

/GettyImages-580502689-578f02c03df78c09e9bbe87b.jpg)

8 Exclusive How To Take A Loan From Your 401k. Complete a loan request application (online or by paper) and submit. Your 401 (k) plan may allow you to borrow from your account balance. Should i take out a loan from my 401k homeowners with renovation projects more than 50000 must consider finding additional sources of funding aside from a 401k loan. How to take a loan from your 401k

If your employer offers a 401 (k) to employees as part of your retirement savings strategy, chances are you could be eligible to take out a loan from your contributions. They work like normal loans—you pay origination fees and interest—only you’re borrowing money from. Ask what the maximum amount you can borrow is and the terms of any loans you take. How to take a loan from your 401k

It's like taking out a loan with 40% interest to pay off your debt. With a 401 (k) loan, you borrow money from your retirement savings account. However, the actual maximum amount you can borrow from your 401 (k) may be less, depending on what your plan allows. How to take a loan from your 401k

If the first 401 (k) loan used up the irs limit, you may not be allowed to take another loan until you have fully paid the loan. They are also an available source of liquidity in a pinch, unlike other retirement accounts. Your 401(k) portfolio is generating a 5% return. How to take a loan from your 401k

Your plan may even require you to repay the loan in full. Many 401 (k) plans allow you to borrow up to 50% of your vested account balance, up to a maximum of $50,000, before you retire. If you plan to borrow from your 401(k), you should know how long it takes to get the 401(k) loan. How to take a loan from your 401k

When you take out a loan from your 401(k) plan, you’ll get terms like you would with any other type of loan: Also, while your goal should be to repay your 401(k) loan in full and on time, if you do default, it will not hurt your credit score. Once you take the loan funds, you can use them for. How to take a loan from your 401k

Confirm that you can take a loan against your account. Get a copy of the paperwork required to. Granted, you're repaying the loan back to yourself and the interest rate may be low, but it's not free money. How to take a loan from your 401k

In addition, 73% of these employers also allow employees. With a 401 (k) loan, you borrow money from your retirement savings account. However, you should consider a few things before taking a loan from your 401 (k). How to take a loan from your 401k

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. Something else to note about 401(k) loans is that Partial loan payments cannot be accepted. How to take a loan from your 401k

A type of mortgage where the interest rate paid on the outstanding balance is indexed to a interest rate benchmark plus a margin, and the actual total mortgage payments are. Some plans also have a minimum loan amount that can be requested. We designed the solo 401k to be easy and (dare we say it?) fun to use. How to take a loan from your 401k

Typically, you can borrow a maximum of $50,000, or half of your vested balance, whichever is lower. Contact the vanguard 401k plan administrator. When you take a loan from your 401(k), it must be repaid with interest. How to take a loan from your 401k

You can take out a loan against it, but you cant simply withdraw the money. If you don’t repay the loan, including interest, according to the loan’s terms, any unpaid amounts become a plan distribution to you. You can borrow from your 401 (k) account multiple times as long as you don’t exceed the irs limit. How to take a loan from your 401k

Find out the duration the direct deposit or mailed checks will take to arrive. If you leave your company, try to pay your 401(k) loan back. Contact your hr department or benefits manager to request a loan from your 401 (k). How to take a loan from your 401k

Because rules vary from plan to plan, you should check with your plan administrator to be sure. When a 401(k) loan is the only option you have, your 401(k. Let's say you could take out a bank personal loan or take a cash advance from a credit card at an 8% interest rate. How to take a loan from your 401k

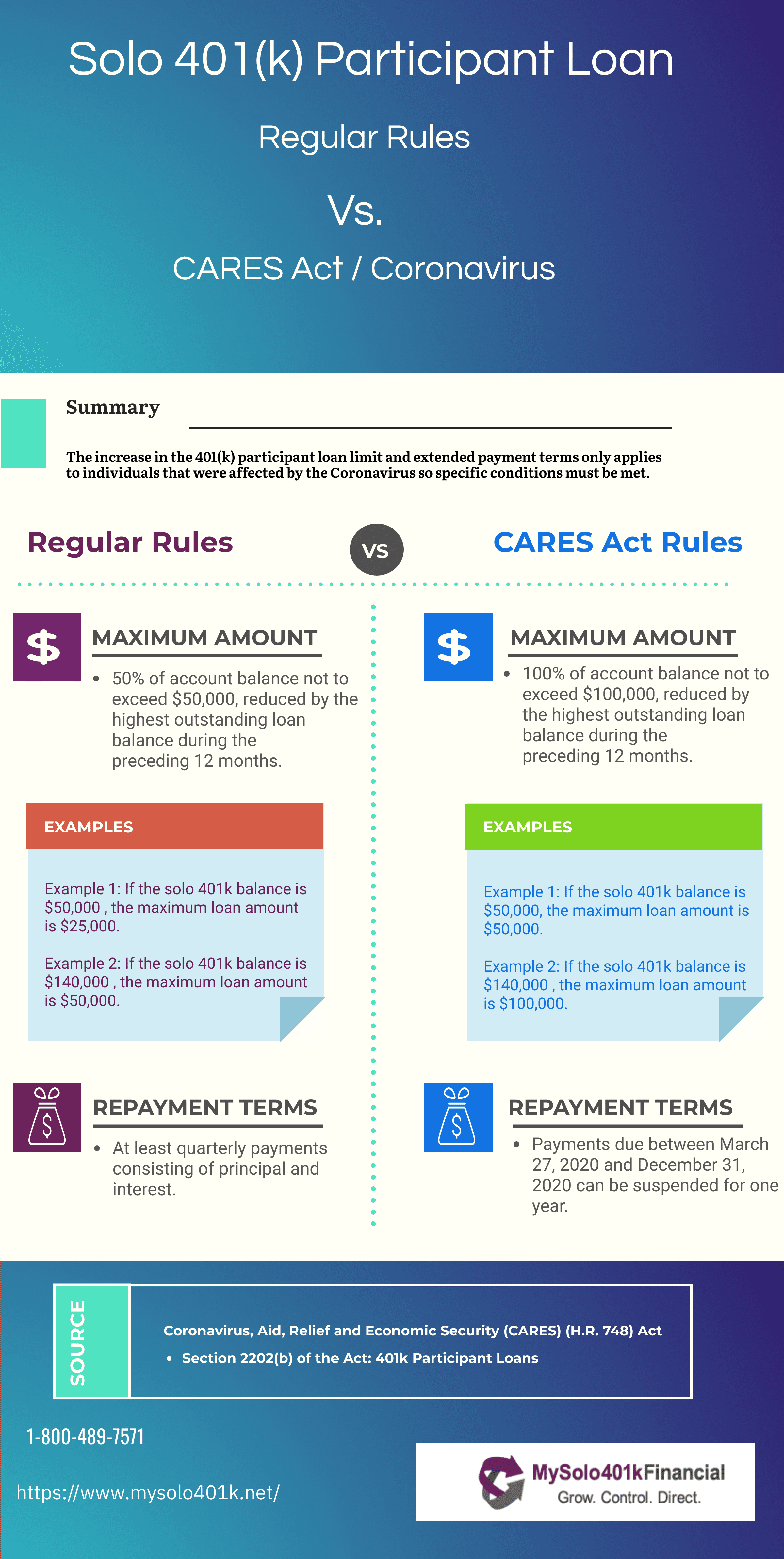

Generally, you may be able to borrow money from your 401 (k) plan account if your employer's plan offers loans. A 401(k) loan is a loan you take out from your own 401(k) account. Note that the cares act permits plans to offer increased loan limits above the $50,000 standard limit. How to take a loan from your 401k

There’s a repayment plan based. Verify that loans are allowed in your plan, and find out how you repay. Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most. How to take a loan from your 401k

Borrowing money from your 401(k) fund is a quick and easy way to gain access in a pinch to up to $50,000 in emergency cash. How to take a loan from your 401k

4 reasons you should never, ever take a 401(k) loan Loan . Borrowing money from your 401(k) fund is a quick and easy way to gain access in a pinch to up to $50,000 in emergency cash.

4 reasons you should never, ever take a 401(k) loan Loan . Borrowing money from your 401(k) fund is a quick and easy way to gain access in a pinch to up to $50,000 in emergency cash.

How To Take Out A Loan On Your 401k . Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most.

How To Take Out A Loan On Your 401k . Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most.

Solo 401k Loan Rules and Regulations My Solo 401k Financial . Verify that loans are allowed in your plan, and find out how you repay.

Solo 401k Loan Rules and Regulations My Solo 401k Financial . Verify that loans are allowed in your plan, and find out how you repay.

How to Pay Off a 401K Loan Early The Budget Diet . There’s a repayment plan based.

Can You Take Out Of 401k To Buy A House House Poster . Note that the cares act permits plans to offer increased loan limits above the $50,000 standard limit.

Can You Take Out Of 401k To Buy A House House Poster . Note that the cares act permits plans to offer increased loan limits above the $50,000 standard limit.

Can U Take A Loan Out Of Your 401k Loan Walls . A 401(k) loan is a loan you take out from your own 401(k) account.

Can U Take A Loan Out Of Your 401k Loan Walls . A 401(k) loan is a loan you take out from your own 401(k) account.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) 401k Loan Transfer Rules Image Transfer and Photos . Generally, you may be able to borrow money from your 401 (k) plan account if your employer's plan offers loans.

401k Loan Transfer Rules Image Transfer and Photos . Generally, you may be able to borrow money from your 401 (k) plan account if your employer's plan offers loans.

Can You Pay A 401k Loan Early Loan Walls . Let's say you could take out a bank personal loan or take a cash advance from a credit card at an 8% interest rate.

Can You Pay A 401k Loan Early Loan Walls . Let's say you could take out a bank personal loan or take a cash advance from a credit card at an 8% interest rate.